Buy Now, Pay Later

Get the product or service you need and cover immediately your needs

-

Automated decision making

Submit your application and get instant approval wherever you are

-

Reusable limit

Get approved for minimum €500 to €3,000 or pending on Bank evaluation and then create Purchase Plans within your available limit

-

Buy wherever and whenever

Create a Purchase Plan and make purchases either in physical or online stores

-

Flexible Repayment Plans

Choose a repayment duration of 3, 6, or 9 months. Terms and conditions apply

Get your Fleksy plan today and pay later

More information

-

Fleksy is an overdraft and a sight account linked to a debit card. Through the Buy Now Pay Later mechanism, you can make instant purchases and pay in monthly installments, easily and quickly.

The service offers a reusable limit for purchases in physical/online stores, through the creation of Purchase Plans. Purchases are made by using the digital Fleksy Visa Debit card which is issued automatically and can only be used for the Fleksy service.

-

Individuals who are permanent residents of Cyprus who are interested to immediately cover their personal needs for the purchase of products and services.

-

The Fleksy service is free of charge, while purchase plans incur a service charge depending on their amount and duration. See the calculation method in the FAQ.

-

You can submit your request for the Fleksy service through the BoC Mobile App by selecting a reusable limit from €500 to €3,000 or in the manner that this will be assessed by the Bank. The choice of your funding amount, as well as the repayment period of your Purchase Plans (3/6/9 months), is at the discretion of the Bank based on your creditworthiness assessment, in accordance with the Bank's internal policy.

-

Yes, you can download the BoC Mobile App and register as a customer. You will then be able to connect as a subscriber (terms and conditions apply). You can then request this facility via the BoC Mobile App.

-

Can I proceed with multiple Purchase Plans?

It is permitted to make multiple purchases at the same time through the creation of separate Purchase Plans for each purchase within the available Fleksy Limit, provided that the previous Purchase Plan has been activated.

Up to what amount can a Purchase Plan be created?

The amount of each Purchase Plan can be up to the available limit for which you have been approved. Each time that an installment is repaid, the available limit is then increased by the same amount approved.

What is the repayment period of each Purchase Plan?

You can choose the duration of each Purchase Plan between 3, 6 or 9 months. There may be restrictions on the selection of the repayment term depending on your repayment ability and the Bank's credit policy at the time of the creation of the Purchase Plan.

-

What is the interest rate?

No interest rate applies for the Fleksy service. Each purchase plan is charged with a 6% Service Charge depending on the amount and duration.

What are the initial costs?

The service is offered at no initial cost.

You can obtain information about all of the Bank's charges from the Table of Commissions and Charges

-

Fleksy is currently available for use in EUR.

-

The following exceptions apply:

- Airlines

- Hotels/ motels and resorts

- Car rentals

- Bill payments (electricity, gas, water and sewerage)

- Petrol Stations

- Online games or gambling

- Government bodies

- Subscription Services

- Illegal activities.

You can find more information about our product exclusions here.

-

How can I check the process of my application?

You can view your application through the BoC Mobile App. You will also receive a notification via SMS once your application has been assessed.

Can I apply together with another person?

The Fleksy service is offered individually, to only one customer.

Are securities required?

The service does not require any security.

What if I change my mind?

There is a right of withdrawal within 14 calendar days from the date of conclusion of the agreement without providing any reason.

What supporting documents should I submit?

You may be asked to provide proof of income during the online application process.

When will the approved limit be available?

If your application is approved, the amount of the limit will be available no later than the business day following the date of signing the contractual documents and you will be able to immediately proceed with the creation of a Purchase Plan.

Can I have more than one Fleksy limit?

Only one Fleksy limit can be approved.

How will I know if my request has been approved?

You will know immediately upon submitting your application through Internet Banking or BoC Mobile App.

What is the Annual Percentage Rate of Charge (APRC)?

- The Annual Percentage Rate of Charge (APRC) is the total cost of the loan that is granted to the consumer. For the calculation of the APRC, all payments made by the customer either to the Bank or to third parties (e.g. government expenses, valuation costs, insurance policies, etc.) are taken into account.

- The APRC is considered to be the best tool for comparing the actual cost for the client, as it includes all of the costs of the loan. It helps you get a complete view and to compare the different plans of the Bank or even to compare the plans between banks.

How does the Bank of Cyprus ensure my privacy and the management of my personal data?

The Bank is committed to ensuring your privacy and the management of your personal data in an open and transparent manner. You can find out more in the Bank's Privacy Statement where you will also find other details about your rights, such as the right of access, the right to correction, the right to file a complaint, etc.

What does the automated evaluation of my application, the automated decision-making process and the automated processing of my personal data, entail?

The application for the Fleksy service is assessed electronically based on your creditworthiness, your repayment ability, and the Bank's credit policy from time to time.

A decision is taken for the approval or the rejection of an application that is submitted online after processing your personal data by using only automated means, including profiling, without human intervention and only after you have given us your explicit consent.

Profiling under this process entails the automated processing of your personal data for analysis, evaluation and prediction of your creditworthiness and your ability to repay the proposed facility.

The Bank will use only the necessary information that enables the assessment of your creditworthiness and your repayment capacity, so that it can take a responsible, fair and informed decision on whether to grant a credit facility or not.

The Bank will use the information that you have provided, as well as information deriving from the Bank’s internal sources (i.e. your personal data and contact details, employment data, income, expenses, Central Bank of Cyprus expenses references are taking into consideration, family structure, consumption habits, behaviour regarding other accounts/facilities/guarantees/collateral, arrears in other accounts/facilities, debts based on a court decision, whether your personal data has been confirmed, any updates for anti-money laundering purposes) as well as from external sources (i.e. bankruptcy data such as debts, non-performing loans and debts based on a court judgment owed to other banks from Artemis Credit Bureau). You can learn more in the Bank's Privacy Statement,

Furthermore, the application may be automatically referred by an officer to the Bank for further assessment.

In addition, in justified cases at the pre-contractual stage as well as after the conclusion of the distance contract, you have the right to provide adequate explanations through human intervention on the part of the Bank, free of charge, during the Bank’s working hours.

If I am rejected, do I have the right to appeal against the automated decision?

Yes, it is possible to request a reexamination of your application by contacting any branch of your choice.

Can I withdraw from the application process at any time either before submitting the application or after the Bank has taken a decision?

You can withdraw your application at any time. If you enter any information, you have the option to save it and to continue with the submission of the application at a later stage and/or to withdraw the application. If you choose to withdraw your application, the information you have entered will not be saved. Your application will be withdrawn automatically if it remains dormant for 15 days.

If the Bank has already taken a decision, you may still withdraw your application at any time before proceeding with signing the contracts but within the term of validity of the decision which is mentioned in the relevant notification for the grant of the facility. This does not affect your other rights concerning the processing of your personal data. You can also withdraw from the contract within a specified period and under certain conditions.

Further information on the right to withdraw from the contract will be given to you in the terms of use of the Fleksy Service, through the pre-contractual information, as well as in the agreement for the grant of the facility.

If I am not approved, can I reapply?

You may reapply for the Fleksy Limit after three (3) months from the date of rejection of your application.

How can I sign my contract documents upon approval? Is it possible to use an electronic signature?

Once your application is approved, you will receive a relevant message both on your mobile phone and through 1bank.

You must sign using an electronic signature provided that certain conditions are met. If the conditions are not met, then you will be informed of the actions you need to take in order to be able to sign electronically.

If I am entitled to sign using an electronic signature, how is the purchase made and what is the cost?

The electronic signature will be used exclusively for signing the documents required for the specific financing. There is no charge.

How will I receive the Financing Agreement?

You will receive the financing agreement electronically and you can also sign it electronically.

My financing application was rejected. What can I do?

You can find out more information about the reasons for the rejection at the branch of your choice.

How will I get informed about the status of my Limit?

You can be informed at any time through the BoC Mobile App.

Within which period can I use a purchase plan that I have created?

You can use your purchase plan within 2 days. If you do not proceed with the purchase of products/services on time, the purchase plan will be canceled. You can, of course, create a new purchase plan from the BoC Mobile App.

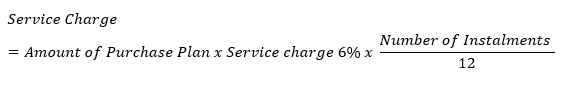

How is Fleksy's Service Charge calculated?

The Service Charge (6%) for purchase plans is calculated on the amount of your purchase plan and the repayment period according to the calculation below:

In case a Purchase Plan shows delay in the repayment of the principal or of the charges, then costs for delay (the ‘Delay Charges’) will then be charged as follows:

- 5 euros per month for the first sixty (60) days of delay

- 20 euros per month in case delay persist beyond sixty (60) days

Furthermore, if your Purchase Plan(s) shows delay of more than thirty (30) calendar days, then your Fleksy Overdraft account and Fleksy Card will be frozen and the creation of new Purchase Plans or the use of existing Purchase Plans that have not been used will not be permitted.

What do I need to know about the payment of the instalments of Purchase Plans?

- The installment of each Purchase Plan will be paid automatically monthly from an account that you specified when you submitted your application.

- You must pay your instalments in the manner foreseen by the terms of the Fleksy service.

- Your Purchase Plans are subject to a Service charge that is calculated in the manner set out above.

- The Service Charge will be divided equally over the monthly instalments.

- In case of delay in the payment of the instalments, additional costs will be charged, thus increasing your costs.

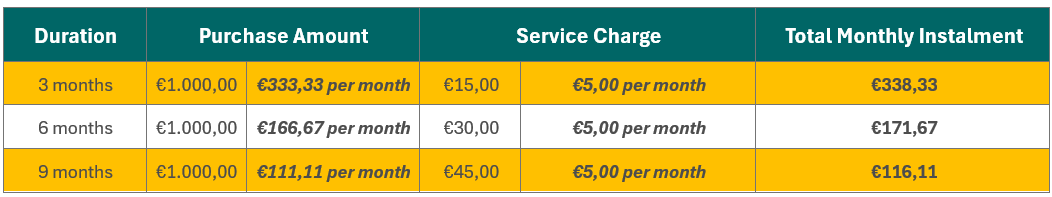

Example:

Purchase of a product (e.g. a TV) worth €1,000 through a purchase plan. A service fee will be charged and repaid according to the duration as follows:

What happens in case of an early repayment/early payment of instalments?There is no extra cost.

What will happen if the Purchase Plan I have created is for a greater amount than the purchase I want to make?

If the purchase you have made is for a smaller amount than the amount of the Purchase Plan, then the transaction difference will be transferred to your limit that is available.

Will my installment be fixed for the entire repayment period?

Yes, the installment for each repayment plan within the Fleksy limit will remain fixed for its entire duration.

Can I pay part or the whole purchase plan early?

You can make an early repayment of the next instalment or of the entire balance of the purchase plan.

Can I cancel a purchase plan?

No. You can either repay it as agreed with the Bank or repay it early.

Why should I be consistent in my payments?

In case of delay in the payment of instalments, you will pay additional costs, thus increasing the cost of servicing your plan.

How can I cancel my purchase?

The Bank is not involved in the cancellation of any purchase. For this purpose, you should contact the provider of the product/service directly. You are responsible for repaying the purchase plan as agreed with the Bank.

If the product is returned, who will be credited the refunded amount?

The refunded amount will be credited to the financing account that you will specify at the time of your application, from which your purchase plan is repaid. By using this amount, you can proceed with the early repayment of your plan. It is understood that you are obliged to pay the purchase plan in the manner that you have agreed with the Bank.

-

- Terms of use for the Fleksy service

- General and Special terms of the Fleksy sight account

- General and Special terms of the Fleksy card

- General Terms of Fleksy Purchase Plans

- Terms and Conditions of the QuickAccount

- The Payment Services Directive (PSD2)

- 1bank Terms and Conditions

- Cards Terms and Conditions

- Bank of Cyprus Privacy Statement

- Deposit Guarantee and Resolution of Credit and Other Institutions Scheme (DGS)

- Table of Commissions and Charges (Physical Persons)

- FATCA/CRS

- Fee Information Document

- Model Withdrawal Form from the Distance Agreement

- Google pay: terms-and-conditions-en.pdf

- Apple Pay: apple-pay-bank-of-cyprus-terms-and-conditions-en-from-230823.pdf

Can’t find what you’re looking for?

800.00.800

+35722128000 from abroad Monday to Friday, 07:45 - 18:00 Saturday and Sunday 9:00 - 17:00Find your nearest Branch

Or use one of our ATMs for your everyday transactionsA specialized officer

can get in touch with you to discuss everything you need to know about our products